Editor’s note: Despite voting against the parcel tax, the WSCUHSD is set to reconsider the tax during a meeting on Monday night, Nov. 23.

The West Sonoma County Union High School District (WSCUHSD) board voted 3-2 to reject a motion to place a parcel tax measure on a March ballot as bridge-funding for more time for community input on a consolidation decision at their Nov. 18 regular meeting over Zoom.

Board president Jeanne Fernandes and trustee Diane Landry said they were wary of the parcel tax measure sharing a ballot with another tax measure intended to boost west county district funds. Trustee Ted Walker was the third opposing vote.

The Sonoma County Board of Supervisors approved the West County Transient Occupancy Tax Ordinance on Nov. 17, with 5th District Supervisor Lynda Hopkins in front.

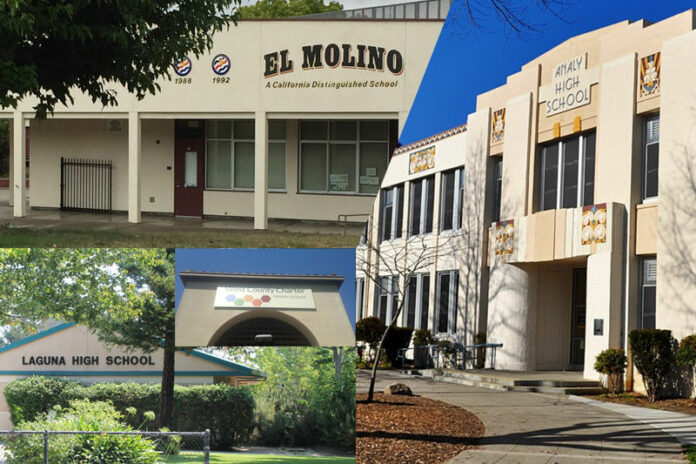

The school board paused nearly five hours into the meeting to postpone discussion and possible action on the potential consolidation of El Molino, Analy and Laguna high schools until a special meeting 6 p.m. Monday, Nov. 23, adding discussion of the transient occupancy tax to the agenda.

Board vice president Kellie Noe and trustee Angie Lewis cast the two supporting votes after Superintendent Toni Beal denied a request to postpone the parcel tax decision until further discussion of the transient occupancy tax measure.

Without another entity shouldering the costs, the district would have had to cough up anywhere from $90,000 to $180,000 for a special election by mail-in ballot, according to Greg Isom, managing principal of Isom Advisors. The money would’ve been drawn from the general fund, Chief Business Official Jeff Ogston said.

The county’s transient occupancy tax (TOT) proposal would increase lodging taxes in west county by 4%, directing revenue toward “first response emergency medical services provided by local fire agencies, to support the consolidation of local fire agencies, and to support west county schools and education opportunities,” according to the board of supervisors’ Tuesday agenda.

“Supervisor Lynda Hopkins, you also need to support the west county high school board and demonstrate your financial responsibility to spend Sonoma County money where it is most needed,” said Judi Gooden during public comment for items not on the meeting agenda. “Keeping under-attended schools functioning is not responsible leadership.”

Fernandes said afterward that those commenting during the non-agenda-item input session were required to refrain from discussing items that were on the agenda, like consolidation, which Goodin said was the only financially responsible decision to save teacher jobs and programs the area was known for.

Hopkins spoke next, thanking Fernandes for spending over an hour on the phone with her that day to discuss the transient occupancy tax proposal.

“I don’t have time in three minutes to fully explain the west county TOT district proposal, but it sounds like there are already some misconceptions and misinformation about it out in the community. It is about providing bridge-funding and ultimately augmenting and enhancing the education of west county’s future generation,” Hopkins said.

Hopkins, who lives in Forestville, made several appearances at town halls and meetings over the past month to advocate for slowing down the timeline and pursue alternative funding to prevent the closure of the El Molino campus.

Many attendees have suspected the Forestville site would shut down if the schools consolidate, although trustees and administrative officials said in previous public meetings that they first needed to decide whether to consolidate at all and then commission impact studies before coming to any conclusions.

For information on the rough cost estimates of consolidating onto either the Analy or El Molino site, visit past reporting on the WSCUHSD’s Facilities and Operations Feasibility Study here.

Fernandes said later in the meeting that she did speak with Hopkins over the phone and that she thought they had a “meeting of the minds” that day.

“Her reaching across the aisle to me was very helpful, and I’m glad that Kellie has spoken up and has asked us to talk further about this TOT. I also believe that it could very well help us,” she said.

Is there support for a parcel tax?

Isom conducted a poll of 400 households for the district to evaluate support for the parcel tax measure.

According to his pie charts, 47% of respondents said they had children or grandchildren in the district in the past. Parents of students currently enrolled made up 15% of respondents. The poll didn’t survey district families only because the local parcel tax would impact homeowners who may not be connected to the district, Isom said in a previous meeting.

When asked if they would support a hypothetical $90 annual tax per parcel for eight years to provide funding to protect programs, 68% of respondents said yes. The poll assessed support for a range of tax rates to gain a sense of voter tax sensitivity, Isom said. Support for the measure slipped to 63.5% after voter education on possible projects and cost, his presentation said.

Respondents did not display strong support for consolidation, with 45.8% marking they would support merging to save resources and programming when told declining enrollment over more than a decade “led to budget cuts that are impacting the types of programs the district is able to offer students, and campuses that are operating at 50% capacity,” Isom’s slides said.

Respondents who said they would not support consolidating under those circumstances comprised 40.3%, with 9.5% marking they were undecided.

“Just to give you guys an idea, when we did the survey, we weren’t calling college students or 18-year-old high school students, or people that never voted. We are calling pretty much only your high-propensity voters, people that always vote, who generally formulate more of an opinion on these matters,” Isom said.

“How and who decided on who got this poll?” asked attendee Terra Del Drago during public comment. “What geographic areas were polled? I know I never received anything.”

Isom said surveyors generally don’t target polls by specific area because of the different voter demographics in different areas and instead highlight high-propensity voters in the school district.

“We call them fives, sixes and sevens,” he said, meaning those who turned out to vote in five, six or seven of the last seven elections. “I think for you guys, over 50% of the people surveyed are 60 and older. So that’s how it gets broken out.”

Isom continued, “I don’t have the breakdown in front of me when it comes to whether it was Guerneville, Forestville, Monte Rio, Sebastopol voters, or Oak Grove or Gravenstein. I have that data, but I don’t have it here because there’s just loads and loads of data, and I can pull that up if anybody wants to see what it is, but that is why generally, there’s a lot of people that don’t get called because you don’t match the demographics.”

Isom said some people may not have been called because, as an example, there may be only 15,000 high-propensity voters out of 30,000 voters in an area, and narrowing down to households and voters with confirmed active phone numbers may leave pollsters with 8,000 numbers to call, when a survey calls for 400, he said.

Jolene Johnson, an El Molino teacher, said, “It actually reminded me a little bit about voter suppression. You’re going to go to all these people who are always the ones voting and not go to the people who are potentially uneducated or they’re just not in the know.”

Johnson continued, “So, I would say, the El Molino community is fighting strong like they always have, and I know that they always will, so I think listening to them, no one really wants to consolidate.”

The sudden linking of west county schools to the West County Transient Occupancy Tax Ordinance and defeated parcel tax proposal are the latest surprises and developments in a conversation on consolidation that began over 10 years ago, according to a “Frequently Asked Questions” document from Oct. 28 on the WSCUHSD website. The knowns and unknowns that could impact thousands of local families shift around a constricting timeline.

The board last discussed Beal’s presentation of the results of a separate district survey of students, staff and current and partner district parents on potential consolidation. Sonoma West Times & News will be reporting on this development in the coming days.

Numerous attendees voiced their support for the transient occupancy tax during public comment regarding the administration’s district survey. Over the course of the meeting, several thanked Noe and Lewis for asking for more discussion on the transient occupancy tax and others questioned whether Isom’s poll on support for the proposed parcel tax measure was representative of the community.

Ogston must deliver the board’s plans to save or generate $2 million by the 2022-23 school year to the Sonoma County Office of Education (SCOE) in the board’s first interim report that’s due to SCOE on Dec. 15, Beal said at a Nov. 4 town hall about possible consolidation.

Without set plans to make budget changes, like consolidation, to address the $2 million shortfall in the 2022-23 year in that first interim report, Beal said the district will become qualified, meaning the district might not be able to meet its financial obligations in its current year or two following years.

In the event the district classifies as “qualified,” SCOE would formally order a fiscal recovery plan by the second interim in March, the superintendent said.

Meanwhile, the West County Transient Occupancy Tax measure lands in voters’ hands in the March 2, 2021 election, according to the Board of Supervisors’ Tuesday agenda. The district would have to hand out layoff notices to teachers and staff who could lose their jobs if the board resorts to more program cuts by March 15, Beal said at the Nov. 4 town hall.

If the district’s budget doesn’t budge by the second interim in March, WSCUHSD will certify as negative, incapable of meeting financial obligations that year or the next and losing the ability to borrow money — and without that, Beal said, the district would run out of money by June 2022.

Edit: A previous version of this article stated that the first interim report needed to be to SCOE on Dec. 9. The report is due to be presented to the school board on Dec. 9 and to SCOE on Dec. 15.