At the June 12 Healdsburg Unified District School Board meeting district staff went over the preliminary budget for the LCAP (Local Control and Accountability Plan) and budget impacts and outlooks for the district’s overall 2019-20 budget. Public hearings were held for the two items; however, there were no comments from the public.

There was no action taken and the items will return to the June 19 school board meeting (after press time) for final approval. It must be approved no later than June 30.

Steve Barekman, the district’s director of business services, provided a brief update on the LCAP budget overview, the district budget and the challenges of being a basic aid district dependent on property taxes.

Barekman explained that the LCAP is not a budget document, “It is a document trying to lay out your priorities for your high needs groups, it is not meant to be an encompassing budget document for the district, it is not meant to explain everything that we’ve spent,” he said.

He said the main goal of the LCAP budget review is to make the information easier to understand for parents and to identify how the district is serving those high need students: foster youth, English learners and low income students.

According to Barekman it is not meant to include the entire budget of the district, though it does help drive a significant portion of the budget.

The LCAP drives the calculator for the LCFF (Local Control Funding Formula). Under the LCFF, school districts receive a uniform base grant for every student, adjusted by grade level. School districts receive additional supplemental grants for students with greater challenges, defined as low-income students, English learners and foster youth. Districts receive additional concentration grant funding when the numbers of these students enrolled in a district make up more than 55% of a district’s total enrollment. In a Basic Aid district, such as Healdsburg, the LCFF formula determines what the necessary funding level must be, but that money comes from local property taxes, rather than the state.

LCAP

To that end there are a variety of costs not included in the LCAP such as: services for special needs students, post-employment benefits for employees, home-to-school transportation, utilities, facilities maintenance, administrative salaries and benefits and salaries and benefits for classified employees like office staff and custodians.

These expenditures not mentioned in the LCAP amount to $13,170,589.

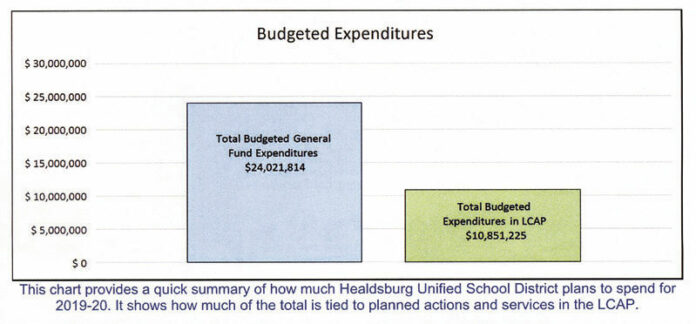

The total budgeted expenditures for the 2019-20 LCAP year is $10,851,225. The total budgeted for high needs students in the LCAP is $2,123,579.

The budgeted expenditures for high needs students in the LCAP last year, 2018-19 was at $1,972,248, however, the estimated actual expenditures came in at $1,701,599.

According to the budget report that was presented, the district was required to spend $1,580,218 last year on high needs students that weren’t special ed. While the district did not spend the full amount budgeted they did spend around 8% more, $121,381, than what was spent on other students.

“The difference between the budget and the actuals were due to a combination of factors — some items were mistakenly overstated in the initial budget, some initiatives were reconsidered and not implemented and some things cost less than budgeted,” the report explains.

Barekman said they over budgeted by about $200,000.

District Budget

Barekman also provided a presentation on the district’s preliminary budget for the upcoming year focusing on potential budget impacts.

“We’ve standardized the budget document over the last couple years getting it to be pretty representative of the budget,” Barekman said of the preliminary budget.

Currently the district is projected to finish the year around $538,000 better in revenue than in expense.

He said it is important to note that this is an early budget and the district will know more and will do more fine-tuning to the numbers once the books are closed and all invoices are in in December.

Last year the district saw a deficit of about $300,000.

The district will end the year with an estimated 17% reserve level.

“Information we have to make very clear to the public is about excess reserves. There’s still this language floating around the state that says you can’t have more than 3% at some point, we’re probably three or four years away from that language being triggered, but it’s getting closer. So why do we have more than 3%?” Barekman said.

He said for the 2019-20 General Fund there is $117,000, and over $3 million in fund 17, the district’s rainy day fund.

According to Barekman the reserves are higher than 3% because board policy calls for a 5% in reserves, not 3%.

Barekman highlighted a few key points that might impact the budget, such as the fact that CALSTRS and CALPERS (California Public Employees’ Retirement System) is becoming a bit more costly for school districts.

He said STRS is projected to go up 16.7% next year and 18.1% for 2021 and then drop to 17.8% in 2022.

Student transportation is also going up in expense.

“We don’t have the drivers on staff to drive most of these trips anymore so we charter them and charter buses are very expensive. So we want to provide some relief to the sites and provide a little money,” he said.

In terms of enrollment he said even with moving kindergarten to HES, enrollment is projected to drop by 27 kids this year due to a large senior graduating class of 56 students.

For employee raises Barekman said the district did a 3% raise this year and another 31/2% starting July 1.

“It is kind of unprecedented for us to do a two-year deal,” Barekman said.

Site allocation funds will be a little bit less the next year due to the projected decline in enrollment.

Last year the allocations were $321,000 and this year it will be $303,000.

Property taxes

“Property taxes are a great dilemma in terms of budgeting,” Barekman said.

Property tax estimates from the Sonoma County Treasurer are from last October, which makes it difficult to determine what estimates for the 2019-20 year could be.

“(Superintendent) Chris (Vanden Heuvel) and I spend more time on this than any other budget conversation we ever have, trying to figure out what’s a reasonable set of assumptions. We want to be realistic, but we don’t want to overstate it and get ourselves in trouble,” Barekman said.

However, he did say they know property taxes are going up, which would be a plus in terms of school funding.

“When you look at our total property tax number for 2019-20, we’re flat, we’re at 0.1%,” he said.

However, he added that property taxes are likely to increase in the next few years.

Bottom Line

The overall General Fund budgeted expenditures amount to $24,021,814.

Projected General Fund revenue includes $18,967,149 from the LCFF, $1,467,101 in supplemental and concentration grants, $1,387,759 in state funds, $1,231,963 in local funds and $741,337 in federal funds, for a total of $23,795,309, for a deficit of $226,505.

50.5

F

Healdsburg

November 23, 2024